Bond selling price calculator

Use Bond Calculator to calculate return on bond investment quickly accurately. The Calculator will price paper bonds of these series.

Excel Formula Bond Valuation Example Exceljet

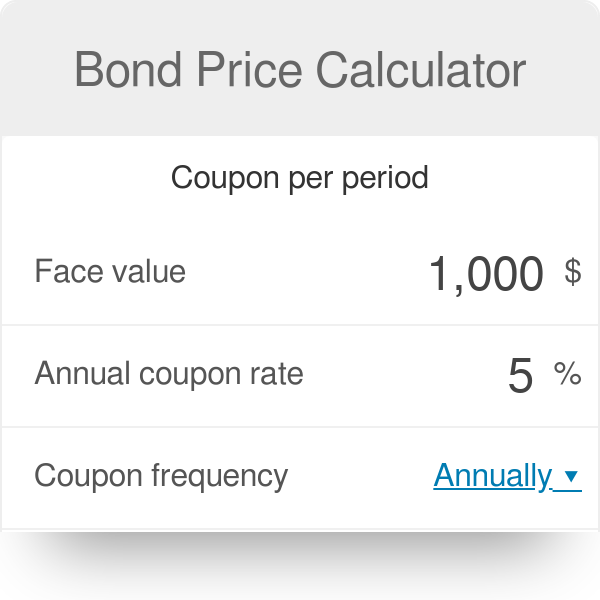

Coupon per period face.

. Assume that a 6 bond having a face value 1000000. Other features include current. 4 Easy Way to Calculate Bond Price in Excel.

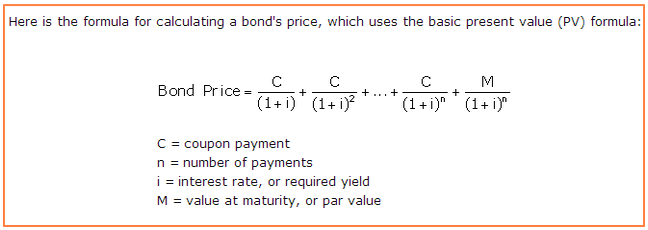

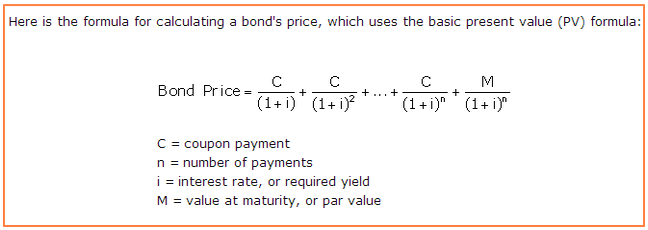

P is the price of a bond C is the periodic coupon payment r is the yield to maturity YTM of a bond B is the par value or face value of a bond Y is the number of years to maturity. Treasury Bills are normally sold in groups of 1000 with a standard period of either 4 weeks 13 weeks or 26 weeks. Find out what your paper savings bonds are worth with our online Calculator.

Calculate Bond Price if. On this page is a bond yield calculator to calculate the current yield of a bond. Bond face value is 1000.

It can be calculated using the following formula. Ad True Investor Returns with No Risk Find Out How with Your Free Report Now. Get A No Obligation Free Quote.

The total of these two present values the market value or selling price of the bond. Annual Interest Payment Face Value - Current Price Years to Maturity. In this example the bond selling price is given as 600.

Check out the easy to understand bond pricer online to know Bond YTM and prices now at IndiaBonds. EE E I and savings notes. You can easily calculate the bond price using the Bond Price Calculator.

If the current market rate is below the coupon rate then the. To calculate the coupon per period you will need two inputs namely the coupon rate and frequency. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

Intuitively an investor will be wary of purchasing a bond that would be harder. Annual coupon rate is 6. If you are considering investing in a bond and the quoted price is.

The formula for the approximate yield to maturity on a bond is. Fast Approval on Low Cost Surety Bonds. For this problem the bond purchase price.

The tax-free equivalent is 4615 x 1-35 which is 3. Calculate either a bonds price or its yield-to-maturity plus over a dozen other attributes with this full-featured bond calculator. Get A Free Quote.

Build Your Future With a Firm that has 85 Years of Investment Experience. Using our US T-Bill Calculator below you are able to select the face value. Working the previous example backwards suppose you calculate a yield to maturity on a taxable of 4615.

Calculating Bond Price Using Excel PV Function. Enter the bonds trading price face or par value time to maturity and coupon or stated interest rate to compute. Ad Save Time Money With Our Expert Surety Bond Insurers.

What is the bond price. Bonds that are more widely traded will be more valuable than bonds that are sparsely traded. First determine the bond selling price.

Example of Computing the Selling Price of a Bond. Using Coupon Bond Price Formula to Calculate Bond Price. Enter the current market rate that a similar bond is selling for only numeric characters 0-9 and a decimal point no percent sign.

Next determine the bond purchase price. Face Value Current Price 2 Lets.

Bond Yield Calculator

Bond Price Calculator Exploring Finance

How To Calculate The Current Price Of A Bond Youtube

How To Calculate Pv Of A Different Bond Type With Excel

How To Calculate Bond Price In Excel

How To Calculate Bond Price In Excel

Bond Price Calculator Formula Chart

Quick Guide On Bond Prices And Formula Bond Calculator Pricing Market Consensus

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Zero Coupon Bond Formula And Calculator Excel Template

An Introduction To Bonds Bond Valuation Bond Pricing

Bond Pricing Formula How To Calculate Bond Price Examples

Coupon Bond Formula How To Calculate The Price Of Coupon Bond

Yield To Call Ytc Bond Formula And Calculator Excel Template

Learn How To Calculate Bond Price Value Tutorial Definition Formula And Example

Bond Pricing Formula How To Calculate Bond Price Examples

Bond Pricing Formula How To Calculate Bond Price Examples